What Is a Credit Builder Loan, and Does It Work?

Build strong credit

while you save

Do credit builder loans really help people build better credit?

We dug deep to find out.

Our analysis included over 50,000 credit builder accounts from a nationwide sample of Credit Strong credit builder loan account holders and findings from a second study by the Consumer Financial Protection Bureau (CFPB) of about 1,500 credit builder loan customers in St. Louis, Missouri.

Within those accounts, we examined specific details about the consumers who opened credit builder loans—including the initial condition of their credit before they applied.

Next, we made note of any credit changes that these consumers experienced in the 12 months after opening a new credit builder loan.

The research revealed some encouraging, and perhaps unexpected, results for consumers who used these loans in the hopes of improving their credit.

6 Things to Know about Credit Builder Loans

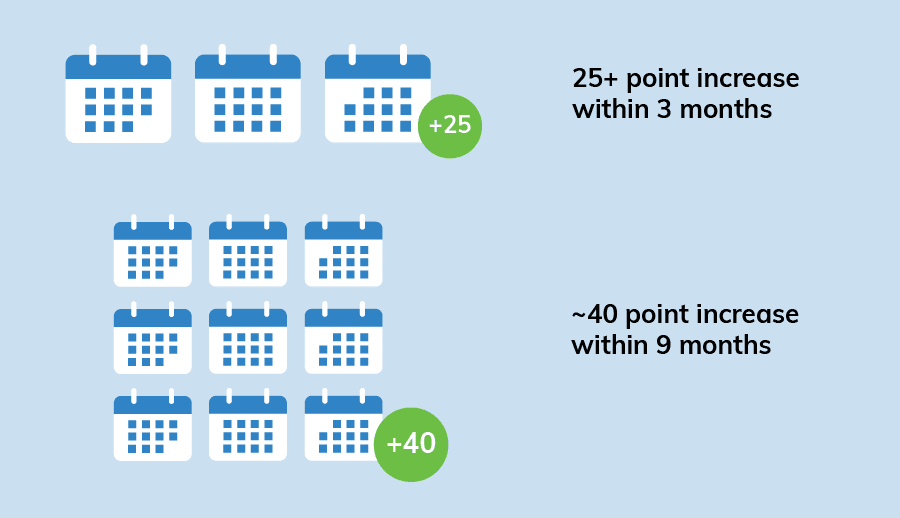

1. In our examination of 50,000 Credit Strong® credit builder accounts, we found that the average account holder increased their FICO® Score 8 by more than 25 points within three months of opening a Credit Strong credit builder account. After nine months the average credit score improvement increased to almost 40 points.

2. Credit Strong account holders that made all their payments on time for 12 months almost doubled that improvement, increasing their credit scores nearly 70 points on average.

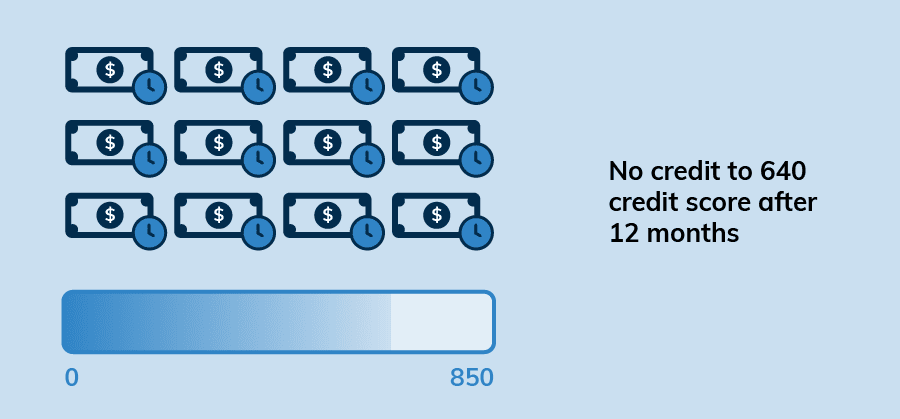

3. Credit Strong account holders with NO credit score when they opened their account earned an average score in the 630-650 range after 12 months (for those who made every loan payment on time).

4. The average FICO Score 8 for someone getting a credit builder account was about 560.

5. A little less than 10% of credit builder account customers initially had no credit score at the time they opened an account.

6. Of note in the CFPB study, 39% of participants who opened a credit builder loan made at least one late payment which could potentially hurt credit scores instead of helping them, so it is important to make sure you budget for making on-time payments when obtaining a credit builder loan.

What Is a Credit Builder Loan?

A credit builder loan is a type of installment loan that may help consumers with no credit or bad credit to establish credit history. Consumers who manage credit builder loans wisely could potentially improve their credit scores. But for those who make their monthly payments late, a credit builder loan could have the opposite effect.

With this credit building product, you usually won’t receive the loan funds right away, like you would with a traditional personal loan.

Every lender is different, but here’s how they generally work:

- You open a credit builder loan with a financial institution, credit union or online lender.

- The lender holds onto the loan funds until you make your final payment, and may or may not pay you interest on the loan proceeds it holds. Loan proceeds are often held in a savings account or certificate of deposit (CD) for the duration of your loan term.

- Loan amounts vary, but often range between $500 and $2,500 (and sometimes higher).

- With each monthly payment, the financial institution may apply a portion of it toward interest and the remainder toward the principal loan amount.

- As you repay the loan, the lender will report your account and payment history to one or more of the three major credit bureaus. This gives you a chance to build positive payment history on your credit report(s).

- Once you make the final monthly payment, the lender releases your loan proceeds, plus the interest your savings earned (if applicable), and minus any loan interest or fees.

Note that each lender has different terms for its credit building loan program. So, the process described above isn’t universal.

Do credit builder loans work?

Opening a credit builder account doesn’t guarantee that your credit score will increase. But if you manage your new account properly, the odds are in your favor.

According to Credit Strong’s internal data set, the average credit builder loan account holder saw their FICO Score 8 increase by more than 25 points within the first three months from account opening.

The average FICO Score improvement jumped to an impressive 40 points at the nine-month mark. (Note: Length of credit history impacts 15% of your FICO Score.)

A 40-point difference in your FICO Score could be huge in terms of financing.

Here’s an example of how much you might save on a 30-year fixed mortgage of $300,000 if your FICO Score moved from 639 to 679 (a 40 point change), based on current interest rates:

- Lower the APR on your mortgage from around 4% to around 3.5%

- Save $163 per month

- Save $58,751 in total interest over the life of the loan

*Estimated savings calculated using the myFICO Loan Savings Calculator.

The Takeaway: A well-managed credit builder loan might help your credit. If your credit does improve, it may be easier to qualify for financing and save money on interest rates and fees.

The importance of on-time payments

Credit builder loans are a tool. You, the account holder, determine whether this special type of personal loan helps you (and by how much) based on several factors.

One of the most important details that determines the impact a credit builder loan has on your credit score is your account payment history. Payment history is the most important factor impacting your credit score and accounts for 35% of your FICO Score.

Our data showed that account holders who made all of their payments on time for 12 months almost doubled the credit score improvement numbers above.

They increased their FICO Scores by nearly 70 points on average.

Remember, if you’re trying to build a good credit score it means that you want to convince future lenders that you’re a good credit risk. On-time payments are a must.

Also keep in mind that the other items on your credit reports can influence FICO Scores as well, not just your credit builder loan account.

The Takeaway: Payment history matters more than any other credit score factor. Pay your credit builder loan late (or any other account), and it may sabotage your credit improvement efforts.

Do credit builder loans work for people with no credit score?

Many lenders who issue credit builder loans do not make credit scores a condition of approval.

So, you can likely qualify for a credit builder loan even if you have no credit score.

In our analysis of Credit Strong’s internal data set, we found that consumers who had no credit score at the time of their loan application had good results on average.

For account holders with no credit score when they opened their account, the average score after 12 months was in the 630-650 range after 12 months of on-time payments.

On a FICO Score scale of 300-850, a score of 630-650 is considered fair. At this level, you still have more work to do to reach the “good” FICO Score threshold of 670.

However, a FICO Score of 630-650 is likely sufficient to help you qualify for certain types of financing, like a mortgage or auto loan, albeit probably not at the most competitive interest rate.

The Takeaway: A credit builder loan might help you to establish a credit score if you don’t have one already.

Pro Tip: If you have no credit history, you can establish a VantageScore® 3.0 (the score commonly provided by free credit score providers) after just one or two months, but to generate a FICO Score, you’ll need at least six months of payment history. FICO Scores are the credit scores most commonly used by lenders to make credit decisions.

When do credit builder loans not work?

Of course, a credit builder loan isn’t a magic wand that can fix any credit problem.

In some circumstances, a credit builder loan might not have a positive impact on your credit. It all comes down to how you manage the account (and the other items on your credit report).

Late payments often cause severe credit score damage. And, unfortunately, not everyone who takes out a credit builder loan to build credit pays on time.

The Consumer Financial Protection Bureau conducted a study on credit builder loans in July 2020. The agency examined 1,531 credit builder loan borrowers, over 60% of whom had an annual income of less than $30,000, who were members of a St. Louis area credit union.

The study found that 39% of participants who opened a credit builder loan paid it late at least once.

The Takeaway: It’s critical to budget for a new credit builder loan before you apply for one. Getting a credit builder loan and making late payments can hurt your credit scores.

The Average FICO 8 Score for Someone Opening a Credit Builder Account was Around 560

People with no credit or a low credit score may be good candidates for credit builder loans since many lenders don’t require a minimum credit score to qualify for this type of account.

Based on our review of more than 50,000 Credit Strong accounts, the average FICO 8 score for someone opening a credit builder account was around 560.

FICO rates a score of 560 as “poor.”

If you have poor credit, it tells lenders that you may be a risk. As a result, some lenders may not be willing to loan you money or open a credit card in your name.

The Takeaway: A credit builder loan may be a good option if you want to build credit, but find it hard to qualify for traditional financing due to credit challenges. These loans might also be appealing if you want to build credit without a credit card.

Nearly 10% of Credit Builder Account Customers Had No Score at the Time They Opened the Account

For people without a credit score, applying for an account that could help them establish one can sometimes feel intimidating.

According to the CFPB, around 45 million consumers have no credit score due to one of the following reasons:

- A “credit invisible” person has no credit file with the major credit reporting agencies and, therefore, no credit score.

- An “unscoreable” person has credit history with at least one credit bureau, but not enough to qualify for a credit score.

However, we found that a sizable number of those in our data set didn’t allow the lack of a credit score to hold them back from applying for a credit builder loan.

Nearly 10% of credit builder account customers had no score at the time they opened an account. (That’s close to 5,000 people.)

These account holders opened an account with either no credit file or a thin file that was insufficient to receive a credit score.

The Takeaway: Even without credit history or a credit score, many people are comfortable opening credit builder loans as a way to start building credit.

Examples of People Who Used Credit Builder Loans

Let’s circle back to an important part of our original question:

Do credit builder loans work?

The answer is yes. Credit builder loans are powerful tools that have helped many people establish credit when used correctly.

Below are two examples.

Example #1: Customer who wants to get a mortgage to buy their first home.

Many people seek out a credit builder loan in the hopes of preparing their credit for a mortgage.

A mortgage, like a credit builder loan, is a type of installment loan.

Lenders need to make sure that you’re likely to repay your home loan before they allow you to borrow such a large amount of money.

So, it makes sense that lenders like to see that you’ve made on-time payments on other installment loans before they approve you for a mortgage.

Paying other installment loans on time doesn’t guarantee that you’ll be able to take out a home loan. But it can often be a positive step in the right direction.

Here’s a hypothetical example.

One customer realized his goal of purchasing a home after he opened a credit builder loan.

After 12 years of living in an apartment because of bad credit, Joshua decided he wanted a change. He was ready to tackle his credit problems and become a homeowner.

A credit builder loan was an important part of Joshua’s overall credit improvement strategy.

First, Joshua checked his three credit reports. Then, he disputed the inaccurate information on his reports.

At the time, Joshua had no open accounts to help build positive credit. So, he opened a credit builder loan and a secured credit card.

Whenever he used his new credit card, he paid it in full by the due date. Most importantly, he always paid both of his new bills on time—every time.

Joshua tracked his progress using a credit monitoring service. The changes he wanted to see didn’t happen over night. But after nine months of hard work, Joshua’s credit scores were strong enough to qualify for a home loan.

While the scenario above is just an example, real people achieve their dream of buying a home by using a credit builder loan. Here’s an actual quote from a Credit Strong customer:

“You guys helped me buy a house. I had a 394 when I started. 18 months later I have a 725!”

Christian April 2020

Example #2: Customer who wants to get a car loan to buy a car.

Auto loans represent another type of installment loan, like mortgages and credit builder loans.

With installment loans you borrow a fixed amount of money and repay it over a fixed amount of time. In most cases, the lender will charge you a fixed interest rate as well.

When you make timely payments on a credit builder loan from a lender that reports to the three credit bureaus, it may help you improve your credit.

This can make you a better credit risk in the eyes of a lender.

Being a better credit risk means you’re more likely to qualify for other types of loans (and better interest rates) than you were before you opened and repaid your credit builder account.

Below is another hypothetical example of how a credit builder loan helped someone qualify for an auto loan.

Amanda needed a new, reliable vehicle. Sharing a car with her spouse was a challenge since they both worked outside of the home. But due to poor credit scores, she was having a hard time finding affordable auto financing.

So, she set out to change her situation for the better.

Amanda had several credit cards that were maxed out, and her credit reports lacked diversity. She didn’t have any open (or closed) installment accounts.

The first step Amanda took was to reduce her spending. This allowed her to start chipping away at her credit card balances and lower her credit utilization rate—an important credit score factor.

Next, Amber opened a credit builder loan account. As she worked to pay down credit cards, she also made the monthly payments on her new credit builder loan. And she always paid on time.

Six months later, Amber’s credit was in better shape. She applied for an auto loan at her local credit union, secured an affordable interest rate, and bought a car that made her very happy.

The scenario above is just an example. Real people do achieve their goal of buying a vehicle by using a credit builder loan. Here’s an actual quote from a Credit Strong customer:

“Thank you Credit Strong! Thanks to you I was able to be approved for a brand new car.”

Jesse March 2020

Conclusion

Building credit from the ground up can be a challenge. And trying to improve poor credit might not be an easy task either.

If you find yourself in either of these situations, a credit builder loan could possibly benefit you.

Before you choose a credit builder program, it’s important to do your own research.

Some lenders require you to dig into your bank account and make an upfront deposit. This hurdle could make it more difficult for you to afford a credit builder program.

Other lenders may not report your credit builder account to every major credit bureau. So, you won’t get full credit for your positive payment history, even if you manage your account flawlessly.

But when you find the right credit builder loan (and pay it on time), there’s a chance you could earn a good credit score and grow your savings at the same time.

FICO is a registered trademark of Fair Isaac Corporation.

VantageScore is a registered trademark of VantageScore Solutions, LLC.

Testimonial Disclaimer: Individual results may vary. Unique experiences and past performance for individuals do not guarantee future results for other individuals. Testimonials may not be representative of all individuals and certain individuals may have inferior results than indicated in testimonials.

CreditStrong helps improve your credit and can positively impact the factors that determine 90% of your FICO score.