How FICO Scores Work

Build strong credit

while you save

Your FICO score is calculated by a computer algorithm that evaluates many sources and types of information on your credit report when you apply for credit. By analyzing the information and patterns in your credit profile to patterns in millions of past credit reports, your FICO score provides lenders a consistent and reliable assessment of how risky it may be to lend you money.

The FICO score has a range of 300-850, with 300 representing an extremely high credit risk and 850 representing an extremely low credit risk.

When a lender receives a FICO score, key “score factors” are delivered with the score. These key score factors are the top factors that affected the score. CreditStrong provides you with the top two factors that are currently impacting your FICO credit score.

FICO’s research shows that people with a high FICO score tend to:

- Make all payments on time each month

- Keep credit card balances low

- Apply for new credit only when needed

- Establish a long credit history

The following is a more detailed description of each category provided by FICO, with a detailed breakdown of each category. As you review this information, keep in mind that:

- FICO scores take into consideration all of these categories, not just one or two.

- The importance of any factor (piece of information) depends on the information in your entire credit report.

- FICO scores look only at the credit-related information on a credit report.

- FICO scores consider both positive and negative information on a credit report.

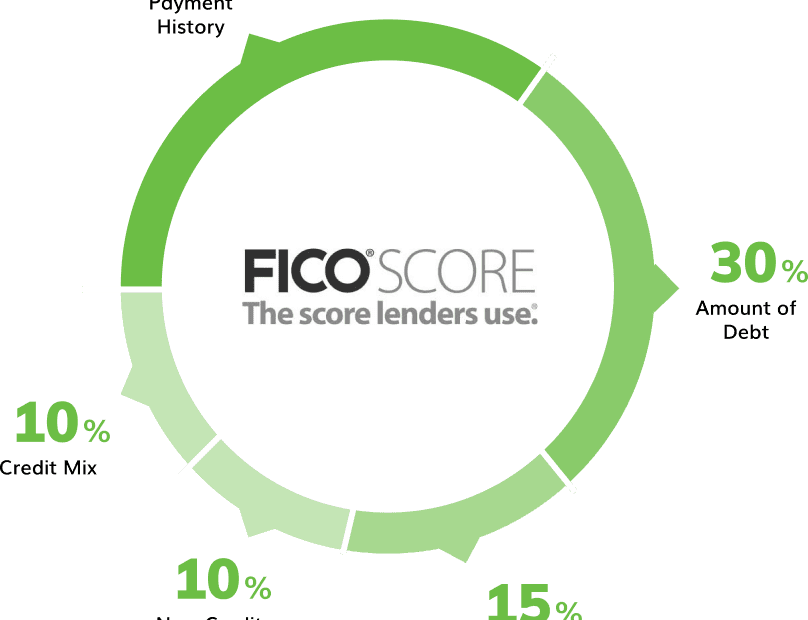

| Factor and Weight | What it Means | How CreditStrong Helps Your Credit Profile |

|---|---|---|

| 35% Payment History |

Payment History The record of every on-time, late, or missed payment for extensions of credits you have received. |

By making your monthly payments on time, CreditStrong helps you demonstrate a responsible pattern of on-time repayment that lenders look for when making credit decisions. Making on-time payments positively impacts your credit profile while missed or late payments negatively impact your credit profile. |

| 30% Amounts Owed |

Amounts Owed How much you owe each creditor individually and in total. It includes your utilization rate for revolving lines of credit (e.g. credit cards). |

When you initially open your CreditStrong account your amounts owed will increase which may cause a temporary small dip in your credit score. As you make regular on-time monthly payments your amounts owed will decrease and it will positively impact your credit profile. |

| 15% Length of Credit History |

Length of Credit History The length and age of each trade line on your credit report individually and in total. |

The longer the term of your CreditStrong account (e.g. 24 months vs. 12 months) the greater the potential positive impact on your credit profile. |

| 10% Credit Mix |

Credit Mix The types of credit used; Revolving: Credit cards or revolving lines of credit and/or Installment: Fixed loan amount and payment. |

Your CreditStrong account includes an installment loan. It is important to have both installment loans and revolving lines of credit on your credit report to maintain a well-rounded credit profile. |

| 10% New Credit |

New Credit New account opening activity and any recent ‘hard’ credit inquiries from lenders on your credit report. |

CreditStrong does not perform a ‘hard’ credit inquiry. Your account will show up on your credit report as a new installment loan. The potential small initial negative impact of adding a new loan to your credit profile will be far outweighed by the positive impact of demonstrating a pattern of on-time repayment. |

CreditStrong helps improve your credit and can positively impact the factors that determine 90% of your FICO score.